The paperless processing of the customs declaration has simplified clearance processes for the Fijian traders as well as expedited procedures for the Fiji Revenue and Customs Service (FRCS).

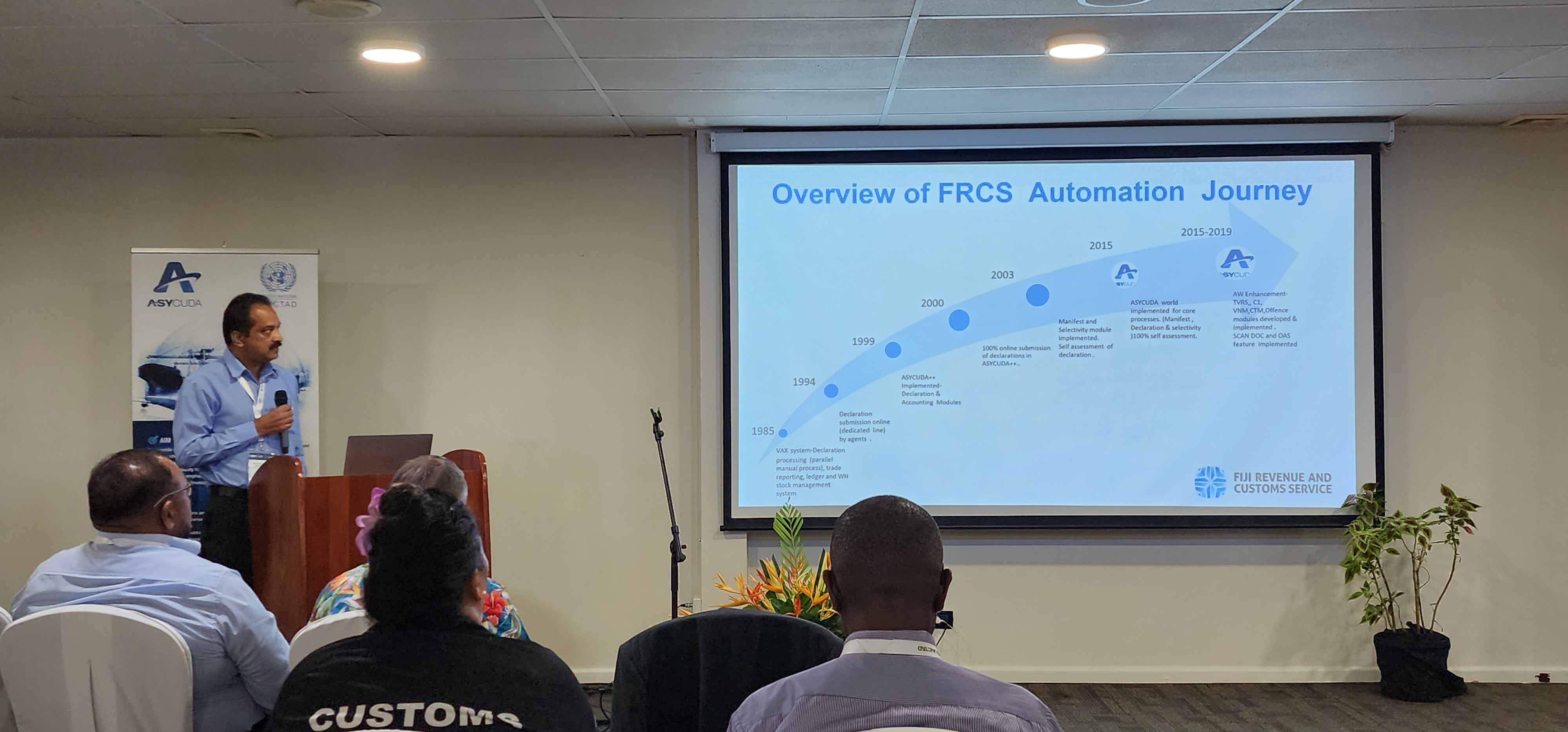

FRCS Chief Customs Officer – ASYCUDA, Mr Sharda Naidu shared this during the United Nations Conference on Trade and Development (UNCTAD) regional workshop on Supporting Trade Facilitation, Digitalization and Digital Transformation in the Blue Pacific.

A customs declaration is an official document that lists and gives details of goods that are being imported or exported.

One of the latest innovations in 2017 was the implementation of a ‘Scan Doc’ feature, which is a built-in tool of the Automated System for Customs Data (ASYCUDA) World system. Developed by UNCTAD, ASYCUDA World is a computerized customs management system that covers foreign trade procedures.

The feature allows traders/businesses to submit scanned copies of their supporting documents through the ASYCUDA system for processing, rather than physically presenting them to FRCS office. The feature not only saves time and money for the traders, but also makes it easier for monitoring and record-keeping by FRCS as it reduces the chances of documents being misplaced or altered.

In 2015, FRCS launched the ASYCUDA World system over the existing ASYCUDA++ with the intention to improve its automation process through module development and implementing newer features that is required for the ASYCUDA World system.

Mr Naidu stated that over the years the processing time for declarations has been significantly reduced as declarations are rapidly available online and customs officers can access and process the documents, eliminating the need for traders to visit FRCS offices.

Mr Naidu further stated that with full automation, processing of customs declaration was not affected during the COVID-19 pandemic. He added that this enabled business continuity during disasters as customs declarations could be processed remotely.

Mr Naidu highlighted that the additional benefit of automation was that auditing has been made easier as large volumes of audit are now carried out within a shorter timeframe.